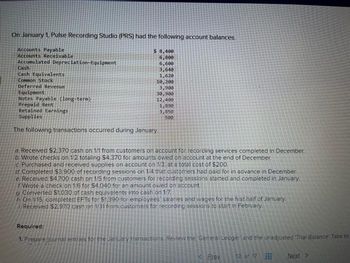

Fannie mae cannot underwrite HomeReady funds privately

The applying is designed to help qualified homebuyers by providing them aggressive interest rates, lower down percentage conditions (as little as twenty three%), and a lot more versatile borrowing from the bank laws and regulations. HomeReady also helps disabled individuals if you take into consideration low-conventional money offer such Personal Safeguards and a lot of time-label impairment professionals.

In reality, Social Defense Disability Insurance rates (SSDI) and you can Extra Protection Insurance coverage (SSI) was both appropriate money present towards HomeReady mortgage system.

Your credit rating have a tendency to impression your own mortgage rates

Broadening upwards inside my family members' home loan team in the fresh new Portland-Vancouver city, I happened to be coached that it is maybe not an issue of if someone else is capable of the reason for home ownership but only a great matter of when.

In addition found that credit rating could very well be a thing reputation when it comes to individuals gaining you to definitely goal. Sometimes, it’s as easy as paying down a premier-borrowing usage charge card otherwise disputing a money to loan Ider, AL wrong late fee towards the a credit file that will make-or-break someone's power to qualify for a mortgage.

New FHA (Federal Houses Management) cannot give money, nevertheless ensures a personal lender’s home loan

If the domestic you may be eyeing are a vast mansion or an excellent effortless farmhouse, GVC Financial can help you select the primary loan for the brand new home in Indianapolis. That have plenty of mortgages and you may programs offered-FHA, USDA finance, and a lot more-we are going to few your with one that fits your financial situation and you may requires. Pertain now in order to agenda an ending up in one of the educated experts, or contact us in the (317) 564-4906 (Indianapolis) or (317) 754-4008 (Plainfield) that have any questions from the obtaining home financing.

Breakdown of Financing Types

We could help you make an application for different family and you will location-certain software that spend less. Realize less than to see which solution fits finest:

- FHA 203(b): For those who be eligible for this choice, the fresh FHA assures the loan. This enables you to definitely shell out nothing-to-no money to your deposit into the Indianapolis. In addition it allows your lender supply low interest.

- Conventional: Because financing actually insured because of the FHA otherwise protected by the new Va, you want good credit in order to be considered. Which mortgage makes it possible for a great deal more versatility and you can freedom than other software do.

- FHA/HUD 100: If you buy a house that has been foreclosed by the Agencies off Homes & Metropolitan Innovation, you might meet the requirements to spend $100 into advance payment.

Paragraph 8 is the asseveration one to Hufana secure financing out of TCT No

Accused Viado filed his Answer on more than-entitled circumstances. In the two cases he admits the fact relating to the filing of the Petition for the Issuance of new customer's duplicates away from TCT No. T-14466 and 14467, but denies which have was the cause of delivery of a special strength out of lawyer to own plus in part of one's customers.

Individual Mortgage loans: What things to Discover Ahead of Borrowing

Such small-label finance, provided by individual loan providers, bring flexibility, quick approvals, and you will usage of finance for many motives such as for example purchasing otherwise refinancing a residential property. not, navigating the field of personal mortgage loans iliar inside.

In this article, we shall explain individual mortgages in simple terms, reflecting what they are, the way they really works, and also the important a few before you borrow. Understanding the intricacies of resource choice often empower that build advised behavior that make with each other your financial situation and you may property capital needs.

What exactly is a private Mortgage loan?

A personal real estate loan was a variety of investment supplied by a private financial as opposed to a traditional lender particularly a bank otherwise a cards connection loans Kiowa CO. Personal loan providers can range off top-notch organizations dedicated to personal money financing to prospects or groups who provide included in their capital collection.

Individual mortgage loans are primarily useful a house deals, generally on buy, refinancing, otherwise collateral extraction out of a residential property.