Several loan providers regarding the county bring attention-only fund, but always simply for periods out of 3 years

Regulators Applications

Balloon mortgage loans try a unique station to possess ambitious people. Balloon mortgages is whenever an enormous part of the lent idea is paid off in one percentage at the conclusion of the fresh new financing several months. Balloon financing are not well-known for most residential customers, but they are more prevalent getting commercial financing and other people that have tall economic property.

These are mortgage loans where payments are applied in order to interest to possess an occasion. The new loan's dominating is not paid back, so that the monthly obligations have become low. The lower monthly payments merely lasts many years, but not. Generally speaking, it is more about 36 months. Following this several months, monthly installments surge since loan's prominent hasn't been less & the rest of the loan should be paid down inside an effective compressed time. Such, to your a good step 3 12 months IO 31-year mortgage, the first three years is actually attention merely payments, then loan principal need to be paid in complete regarding further 27 age.

When being qualified for a loan, a credit score regarding 720 or top will help safer good advantageous financing. Some mortgage brokers features approved borrowers which have fico scores doing 640. The best rates and you will sales might possibly be acquired that have a score a lot more than 740. There is a lot out of race certainly lenders, and therefore environment can cause sweet rewards having individuals. Such as for instance, particular finance companies will offer special offers towards closing costs getting consumers whom qualify. The price could be put in the borrowed funds or the bank will pay the newest closing costs but incorporate a few basis items to the Apr.

An obligations-to-earnings ratio from forty% and a down payment of 20% are what extremely financial institutions like to see to the home financing app.

Partners guarantee a beneficial Trump profit change the device to have mortgages. Some alert it creates all of them pricier

- Express So it:

- express to the X

- share towards the posts

- show for the linkedin

- express into email

S. financial industry and are good personal loans in Florida bedrock of your You

When the Donald Trump victories the presidential election, Republicans hope he's going to see a historical GOP goal of privatizing the mortgage creatures Federal national mortgage association and you may Freddie Mac, that have been around government manage because Higher Market meltdown.

But Democrats and lots of economists alert one, particularly in this time regarding high financial prices, doing this will make to shop for property even more costly.

Republicans participate the fresh new Government Construction Money Company could have been managing new a few agencies far too a lot of time, stymying competition about houses finance business when you're getting taxpayers within risk should yet another bailout end up being expected, as in 2008. Chairman Donald Trump tried so you can totally free the two businesses off regulators control as he was a student in office, however, Joe Biden's winnings within the 2020 stopped those of taking place.

Instead you to definitely make certain, even though, Parrott said you will find an tremendous chance the field will not accept Fannie and you may Freddie's privatization, throwing the brand new casing money sector towards the a mess and you will blocking just about those with clean credit out of to be able to secure a home loan - some thing Parrott entitled a worst-circumstances situation

Democrats worry ending the brand new conservatorship manage bring about financial cost so you can dive once the Fannie mae and you can Freddie Mac would have to improve charges and make up for the improved threats they might deal with rather than bodies service.

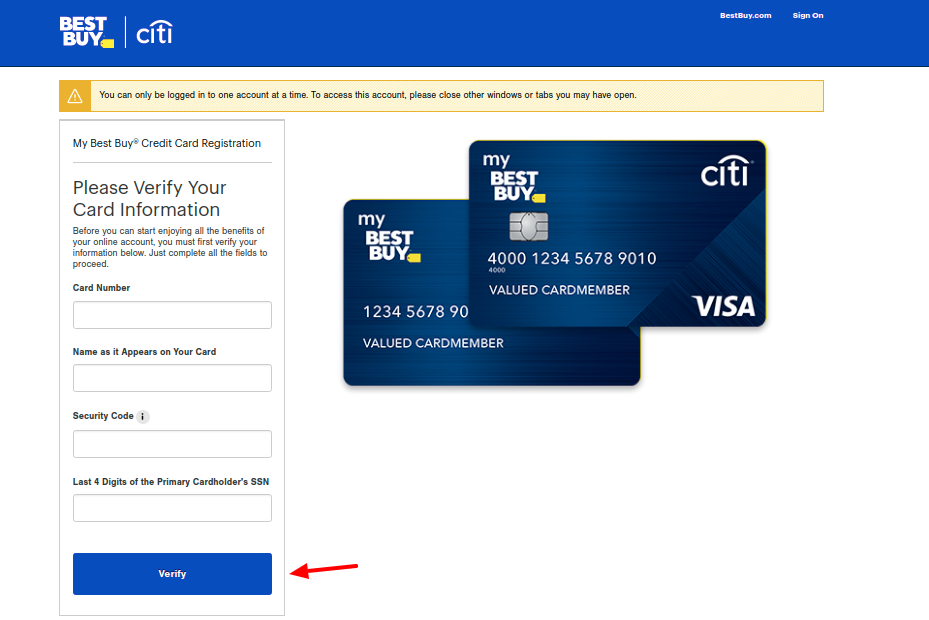

Ensure you get the house loan you are entitled to

You may have located the ideal property, and also you cannot waiting to go inside the. You realize exactly how you would like to renovate the new way of living areas, representative the backyard. In mind, you have already gone in.

Unfortunately, the majority of people earliest need to go through the financial application techniques before they're able to label the selected assets household.

Following correct pointers out-of a knowledgeable and experienced home loan originator can be make clear the bond software procedure and be less time-drinking.

Manager from electronic financial brokering solution MortgageMe, Andrea Tucker, shares suggestions for how to be clear on getting the home loan recognized.

Credit history

One of the first one thing financial institutions take a look at prior to approving a loan software program is your credit score. Your credit rating takes into account how often your sign up for borrowing, whether you are while making the debt money promptly, and you may whether you have any defaults otherwise borrowing infringements up against their name.

You can do this that with shop credit or financial credit cards, opening a cell phone account, or obtaining auto capital. Next, you need to be diligent regarding meeting the monthly payment deadlines.

Credit Commitment Home Loans: Fund Brutal Land at Truliant FCU

You will find a listing of all the Team Partners on the market into the web site. To suggest Discussion Credit Commitment since a corporate mate, delight consult with your Hour Director.

How do i reorder monitors?

Sign in Digital Financial and choose "Reorder Checks" beneath the Services case. You may order yourself through the Deluxe web site.

Whether you're willing to purchase an alternate investment property otherwise re-finance a current you to, Affinity features an approach to see your individual credit means. We provide aggressive home loan choices to the 1-4 household members financing services for both individual customers and team agencies within the New jersey, Nyc and you may Connecticut. Financing Buying Assets - If you are searching having suitable selection upcoming all of our comfy words are just what you are searching for.