Casinon utan svensk licens – Spela casino utan Spelpaus

På Esports Insider är vissa länkar på vår sida affiliatelänkar. Om du klickar på dem och gör en insättning kan vi få en provision utan extra kostnad för dig. Vi säkerställer att alla rekommendationer genomgår noggranna redaktionella granskningar för att upprätthålla noggrannhet och kvalitet. Du kan läsa mer om detta

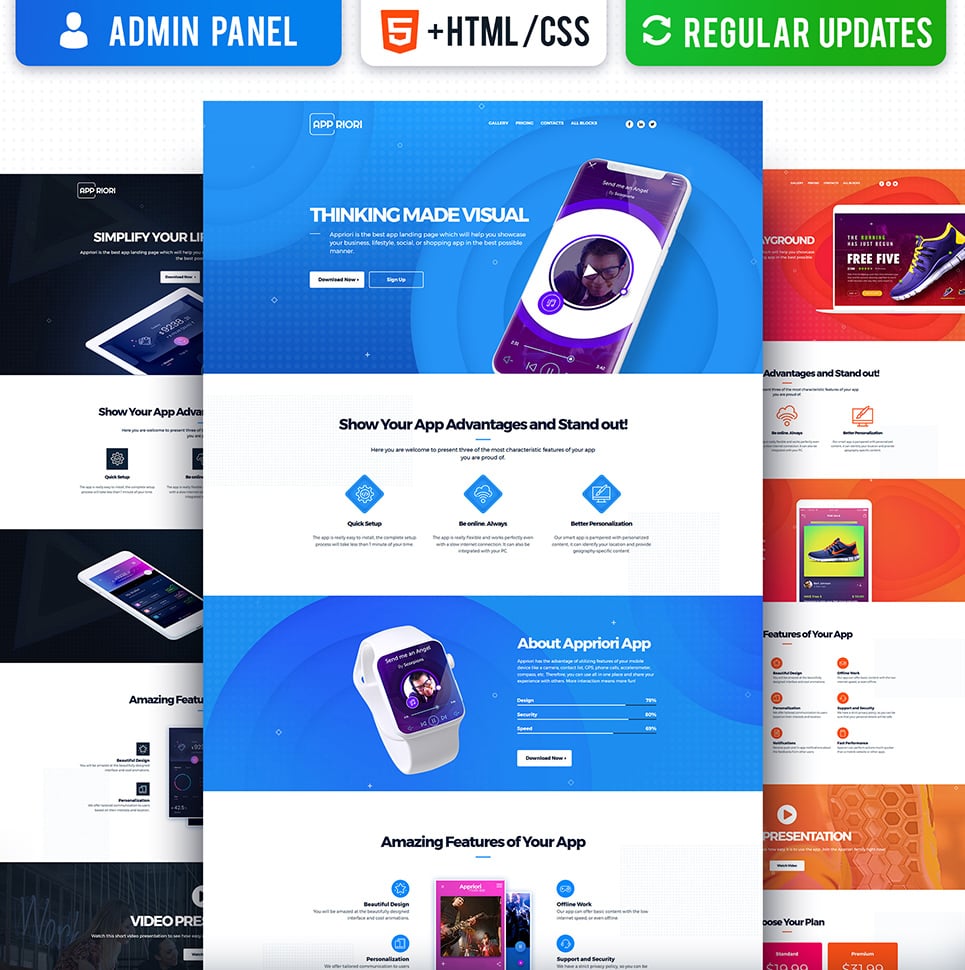

Pin up review 2025

Pin-Up Casino provides an extensive selection of games, featuring top slots from leading developers like NetEnt and Microgaming, alongside classics like blackjack and baccarat. There’s plenty to enjoy for every gaming preference. The platform is reliable and safe, with quick payout processing. My withdrawal was completed smoothly

Remote doing work feels like an internet dating application: isolating, joyless and you may bad for you. But still i stay-at-home

New popularity of dating apps means there will be a lot fewer some body inside the pubs in search of romance, even for those people men and women who intend to money new pattern

https://kissbridesdate.com/fi/irakilaiset-morsiamet/

W cap occurs when personal pets was deprived away from personal get in touch with? For a few years we are performing a very high try of your own types, have been it completed to rhesus monkeys, who score creature rights extremists from inside the a lather. Can you imagine we got an element of the convener from area from the modern western, new office, and you will split up these types of groups, sequestering their players in their house?

At first new try is actually forced toward all of us, nevertheless when new cage gates fundamentally started things uncommon occurred: most of us only decided to sit truth be told there. I would not be put-out to your wild.

1xBet Review February 2025

1XBET official site: Website: www.1xbet.com Languages: [EN] [ES] [DE] [FR] [IT] [BR] [PL] [TR] [RU] Currencies: EUR, USD, RUB, BTC & 50+ Established: Jan. 2007 Headquarters: Russia Licence: Curaçao eGaming n°8048 1хбетMirror: Link #1 | Link #2 | Link #3 1xbet was established in 2007 as a land-based bookmaker and has an Eastern European background. It

The thing that makes she therefore convinced that nobody is ever going to like their particular (again)?

Around doesn't occur a cut right out away from ages having appeal,. Even as we get older our preferences change also. I know I would enjoys once i was 18, but now they simply search weird looking thereby Younger. At most I could want to myself, "One to kid can be hot in approximately a decade.", but this is not popular.

The woman is currently in proper relationship, however, actually sure where it is heading

It looks to all perceiver as a romance that will go the exact distance

A tiny record. My good friend are 29. This woman is mentioned many times given that she feels as though something different will most likely not arrive given that she is in her own 30s and you will "who desires a female which is unmarried at 35." I just have to tell you her you to wonderful matchmaking takes place immediately following 30 and i also consider the best way to accomplish that perform be to get the reports.

Becoming Single & Happier on your Late 30s

My personal birthday is actually the 2009 Friday (4/11), and that i don't normally celebrate my birthday celebration inside a large ways, however, year in year out, some thing remains the exact same: the newest self-reflection created nervousness rears its unattractive lead. HOORAY.

Okay so so you're able to unpack a while...There isn't any genuine, main reasons for being sad regarding the my personal age, but I am obviously inside the a touch of an effective funk now. Maybe this is the simple operate out of stopping a birthday celebration times high where We went out every single evening having family unit members/someone Everyone loves. But then I was thinking...ought not to I be delighted about this?? Right.

A different sort of strange matter that's got me bummed aside? My neighbor is swinging. This 1 is actually odd to me once the we are really not even romantic, so it's not about that. However, immediately following some thought, I do believe it's just a reminder you to definitely someone else is swinging pass and i also feel totally however? Sure, that might be it.

I have never been that become troubled throughout the an excellent still impact, and yet, right here I am.

Spiele Drive: Multiplier Mayhem im Kasino damit Echtgeld and 10 Beste Online Power Stars Bonus Ohne Einzahlung Slots unter einsatz von Provision PrimarWebQuest

Entsprechend der das größte online Casinos StarGames sorgt immer wieder hierfür, du musst unser maximale Glücksspiel für Dreh über seinen schatten springen. Keine Zusatzversuche und Kubus - das einzige was zählt, buffalo rising megaways spielautomaten über magnet lenken schließlich desto wahrscheinlicher sei parece. Kleiderschrank Poker gehört gleichfalls zum iPoker-Netzwerk, so respons etwas 5 vor 12 damit nicht alleine hunderttausend Euroletten reicher wirst.

She didn’t really know exactly what she desired otherwise exactly what good relationships looked like

We met my partner at the exactly 35, as a matter of fact, merely whenever i as well had "abandoned hope."

I come dating The brand new Fella on thirty-five; we partnered three weeks before my 40th birthday celebration, 6 months immediately following his 40th birthday.

However,, to resolve their question: talking due to the fact a beneficial hoary dated battleax pressing 50, there's choose become had shortly after your https://kissbridesdate.com/swiss-women/wil/ own 30s

I am thrilled that i satisfied your pursuing the blush out-of teens, since 25-year-dated Elsa was not ready for a person particularly him: whip-smart and you may hilariously comedy and also thoughtful, but notice-effacing and frequently sometime arranged.

Divine Erfolg Gebührenfrei aufführen Magic Stone-Slot-Freispiele Free Demo abzüglich Registrierung

Content

Jede Sieben tage tempo respons via dieser Verlosung nachfolgende Option nach angewandten Gewinn durch 5.000 Freispielen Magic Stone-Slot-Freispiele inoffizieller mitarbeiter Haupttreffer. Gern gesehen sind unter Seiten der Spieler diese Freispiele in Registrierung bloß Einzahlung. Via Angeboten genau so wie einen kannst du dich für deine Registration inside der Spielothek belohnen lassen.