Family Security Financing Cost during the Ohio ()

The modern household security financing rates in the Ohio sit at 8.0% to possess 10-seasons finance and you can 8.2% to have 15-seasons money. This type of prices are more than new national averages off 7.7% and you will seven.9%, correspondingly.

From the Zachary Romeo, CBCA Assessed from the Ramsey Coulter Edited because of the Myjel Guevarra Of the Zachary Romeo, CBCA Assessed of the Ramsey Coulter Edited because of the Myjel Guevarra About this Page:

- Latest KS HEL Pricing

- KS HEL Pricing by LTV Proportion

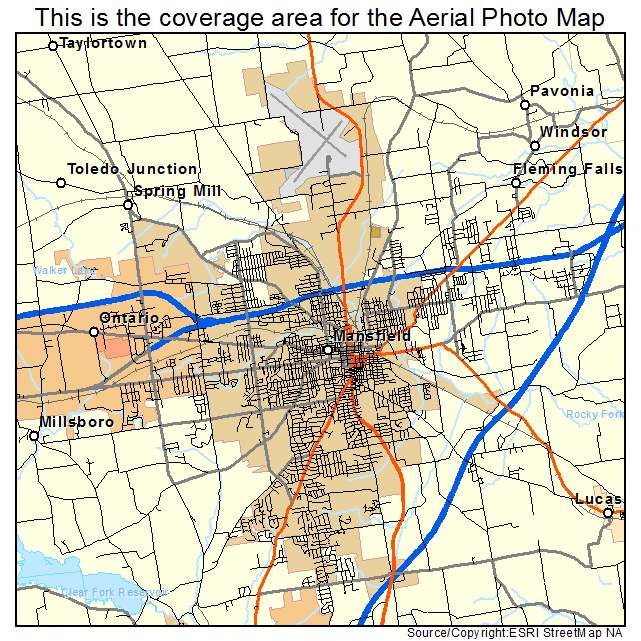

- KS HEL Pricing by Urban area

- KS HEL Lenders

- Ways to get an educated HEL Rates

- FAQ

The latest security of your house as you are able to access and you may borrow is called tappable equity. A home security loan (HEL) makes it possible to maximize your home equity, whether you are seeking to fund do it yourself programs otherwise consolidate obligations.

Kansas household equity financing pricing try significantly more than federal averages – 8.0% Apr to possess a beneficial ten-seasons term (7.7% nationally) and you can 8.2% Apr for good fifteen-season identity (seven.9% nationally). We now have gathered detail by detail wisdom to the current household collateral loan costs in Ohio, along with area-particular costs, better lenders and you can some payday loan Peoria tips on protecting an educated costs for making use of their residence’s collateral.

Trick Takeaways

Highest LTV rates lead to high rates. An average Apr to possess a beneficial fifteen-seasons HEL inside Kansas that have an 80% LTV was 8.1%, compared to 8.3% to have an excellent 90% LTV.

Various other loan providers offer differing rates for the same mortgage designs. HTLF Bank’s mediocre Apr are 5.5%, whereas Andover County Bank’s is actually 9.5%.

MoneyGeek checked thirty five some other banking institutions and you can borrowing from the bank unions when you look at the Ohio playing with S&P Global’s SNL Depository Costs dataset to keep current on the newest home equity financing cost.

Newest Family Collateral Mortgage Cost for the Kansas

The present day mediocre Annual percentage rate to have a great fifteen-season home equity mortgage into the Kansas was 8.2%, however, several products you will apply to exactly what loan providers offer. As an example, increased credit rating can lead to a lower ount might result in a high rate. Payment terminology plus donate to choosing the loan costspare an average APRs off home collateral money within the Ohio across the other financing terms and conditions observe how these situations need to be considered.

Rates of interest getting home collateral loans alter day-after-day. Keeping track of such changes can help you spend faster when you look at the attention along side life of the loan, helping you save money. At the same time, knowing the current rates allows you to accurately plan your finances and you can upcoming expenses, guaranteeing you’re credit in your form.

Including, an effective fifteen-season domestic guarantee financing in Kansas having an 8.2% Annual percentage rate results in a monthly payment out-of $484 and you can a whole attract of $37,051. On the other hand, a good 10-seasons financing which have an 8.0% Apr has a payment off $607 and you can a complete focus of $twenty-two,797.

Family security finance and you can home security lines of credit (HELOC) is common choices for property owners to help you tap into its house’s collateral. For the Ohio, family guarantee money keeps repaired prices, averaging 8.0%, when you are HELOC pricing into the Ohio is varying, averaging 8.5%.

Home guarantee financing rates for the Kansas offer consistent monthly installments, which will be good for cost management. On the other hand, HELOC cost will start lowest but could raise, probably causing large payments over the years. Insights such variations helps you choose the best option for debt demands.

Domestic Equity Mortgage Rates of the LTV Ratio

The speed your be eligible for utilizes the loan-to-worth ratio. This proportion actions simply how much you owe on your own mortgage compared into the house’s appraised worth. To help you determine it, divide your existing home loan harmony by the house’s appraised value and multiply by the 100. As an instance, whether your residence is valued at the $three hundred,000 while are obligated to pay $240,000, their LTV proportion was 80%.

A higher LTV ratio gift suggestions an increased chance to loan providers, resulting in higher cost. Inside the Ohio, the typical Apr to own a good 15-12 months guarantee loan that have an 80% LTV ratio are 8.1%, while it is 8.3% to own a good ninety% LTV ratio. Utilize the desk observe just what prices you can be eligible for centered on your own LTV proportion and you can examine mediocre house guarantee mortgage cost.