Is actually a beneficial 705 credit score good or bad?

Whenever you are interested in providing a loan, particularly a mortgage, car finance, or credit line, it is essential to know what your credit rating is actually. Anyway, it’s your credit score that loan providers used to influence which to help you mortgage their cash to and you can what pricing provide all of them. Generally speaking, the better your credit score, the much more likely you’ll be to be eligible for a great mortgage.

If you a 705 credit history, you are questioning in the event that’s a score or a beneficial bad score. Based on Equifax Canada, among the many country’s several big credit bureaus (organizations that question fico scores), a beneficial 705 credit rating drops for the fair diversity.

Credit ratings in Canada

Your credit score try a good around three digit amount one to range away from three hundred so you’re able to 900. As you can plainly see, there clearly was a wide difference and your get hinges on a amount of situations. Good credit in the Canada opens up doorways so you can beneficial borrowing from the bank alternatives having all the way down rates of interest, if you’re a negative otherwise lowest credit score can also be restrict your supply so you’re able to borrowing or result in higher interest rates. The common credit score from inside the Canada may be as much as 650 in order to 700, but large results are more preferred.

New TLDR is that the high their get, the more credit-worthy you might be calculated become article of the credit agencies and you will, because of this, lenders. A premier credit history unlocks many financial options, such as qualifying getting lower money, best chances of bringing work because the some companies, like those in the new monetary features field, evaluate applicants credit scores while in the background records searches and a higher odds of being qualified to possess accommodations house.

Here’s how Equifax prices their credit ratings:

The typical credit rating from inside the Canada, predicated on TransUnion, are 650. If you a credit history out of 705, that implies you’ve got an average credit rating that’s considered a for the Canada. It is a rating we strive for however you manage not have to stop here. You may still find many actions you can take to alter the rating. Much more about that when you look at the a while.

Credit ratings in the Canada play a vital role when you look at the one’s financial lifestyle. They reflect an individual’s creditworthiness and are extremely important whenever trying to get fund, mortgages, or playing cards. Canadian credit scores are generally counted of the credit reporting agencies, which gather analysis on the credit history and create a credit declaration. Such credit file was then accustomed determine your credit rating.

Keeping a top credit score means responsible financial management. This may involve while making costs promptly, staying bank card balances reduced, and not obtaining an excessive amount of borrowing at the same time. On top of that, an extended, confident credit rating results in a high rating.

Insights what makes your credit rating and knowing your credit rating possibilities is important to have monetary victory from inside the Canada. Keeping track of and you may controlling their borrowing may cause top credit ratings, which often can offer way more economic possibilities.

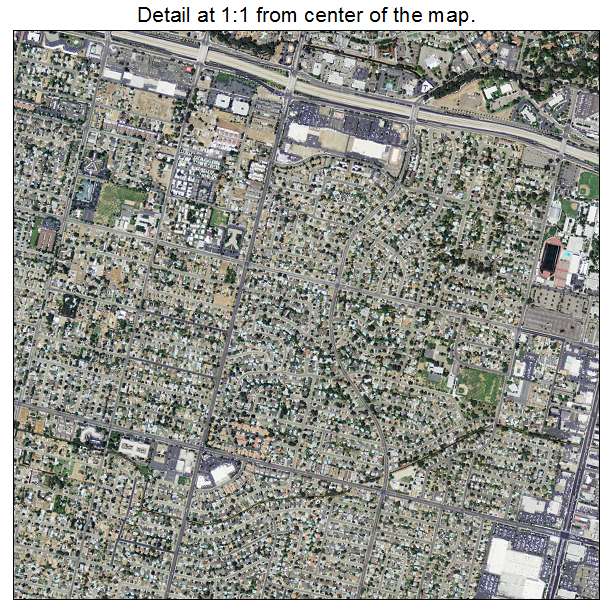

City Average credit history Vancouver 705 Victoria 694 Calgary 667 Edmonton 649 Saskatchewan 659 Saskatoon 656 Winnipeg 661 Toronto 696 Ottawa 688 Montreal 687 Quebec Area 683 Halifax 664 Fredericton 658

As you care able to see, a 705 credit history is largely over the average score for the a few of these urban centers. There are many reason why the get will get fluctuate from time to time nevertheless so much more you understand regarding your credit history and you may what it indicates the simpler time you will see securing their Canadian credit history out-of points one impression your rating.

Factors you to adversely feeling your credit score during the Canada

Within the Canada, credit ratings is actually a serious reason for credit history dedication. Such results are usually mentioned by major credit reporting agencies and fall in this specific credit score ranges, that greatly affect what you can do so you’re able to safer money eg private financing, automotive loans, otherwise credit lines, and even affect the terms and rates of interest of this type of loans. Keeping a credit history with the higher end from the range depends on training good credit activities and you may healthy monetary models.