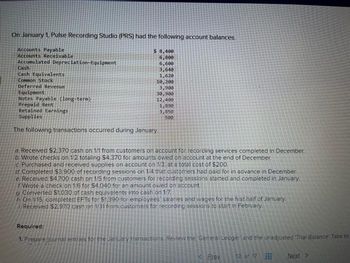

New FHA (Federal Houses Management) cannot give money, nevertheless ensures a personal lender’s home loan

If the domestic you may be eyeing are a vast mansion or an excellent effortless farmhouse, GVC Financial can help you select the primary loan for the brand new home in Indianapolis. That have plenty of mortgages and you may programs offered-FHA, USDA finance, and a lot more-we are going to few your with one that fits your financial situation and you may requires. Pertain now in order to agenda an ending up in one of the educated experts, or contact us in the (317) 564-4906 (Indianapolis) or (317) 754-4008 (Plainfield) that have any questions from the obtaining home financing.

Breakdown of Financing Types

We could help you make an application for different family and you will location-certain software that spend less. Realize less than to see which solution fits finest:

- FHA 203(b): For those who be eligible for this choice, the fresh FHA assures the loan. This enables you to definitely shell out nothing-to-no money to your deposit into the Indianapolis. In addition it allows your lender supply low interest.

- Conventional: Because financing actually insured because of the FHA otherwise protected by the new Va, you want good credit in order to be considered. Which mortgage makes it possible for a great deal more versatility and you can freedom than other software do.

- FHA/HUD 100: If you buy a house that has been foreclosed by the Agencies off Homes & Metropolitan Innovation, you might meet the requirements to spend $100 into advance payment.

- USDA/RD: This option even offers larger coupons for all of us searching for to buy a great house inside rural groups.

- FHA 203(k): Good for fixer-uppers. If eligible to this choice, you imagine how much solutions and you can renovations would rates, following roll those upcoming will cost you to your family price. This provides you you to definitely easy and quick mortgage.

- VA: The fresh new Va claims a beneficial lender’s home loan having experts and you can solution players, providing them to purchase, redesign, otherwise create a home. Since the a thanks for their service, we do not charge underwriting charge.

- Doctor: Made for recently finished scientific people, doctor finance, known as physician mortgage loans, wanted virtually no money down no personal home loan insurance policies (PMI) so you’re able to safe good jumbo home mortgage.

- Jumbo: Jumbo mortgage loans try mortgage brokers one to go beyond compliant loan limitations. A beneficial jumbo mortgage is a sure way to acquire a leading-cost or luxury home. For those who have a lower personal debt-to-money proportion and you will a high credit rating, a great jumbo financing can be best for you.

FHA 203(b)

Consequently or even keep pace your instalments and you can default, the brand new FHA ends up making the remainder of your repayments then provides your house. So it insurance makes the financial less risky to the lender, therefore these include generally ready to give most readily useful terms.

The brand new FHA 203(b) is a well-known system as it has some positives. In some cases, the consumer just has to spend 3.5% of one’s price to your down payment. Instead of so it help, of a lot homeowners have to spend 1020% of your cost for the downpayment. This new FHA 203(b) does away with have to have a good number of currency conserved before buying a property. While doing so, the consumer is also discuss rates of interest towards the FHA.

Conventional Loan

Unlike being insured of the FHA or protected by the Va, a normal mortgage spends the house and you can house as the security facing defaulting. You meet the requirements based on your credit rating. For those who have less than perfect credit, you may not meet the requirements. Your credit rating can be so important because government entities isn’t getting insurance. The lending company must ensure you will be dependable enough to pay back.

If you find yourself much harder to obtain, antique solutions provide a lot more liberty than authorities-covered funds. FHA apps will often have numerous regulations that must be implemented one to traditional financing dont. At the same time, very lenders do not require financial insurance coverage. You can expect fixed or varying interest rates. not, be ready to afford the full down-payment rate for your household.