Before you apply for your Mortgage, Acquaint yourself On Specialized Consumer Toolkit

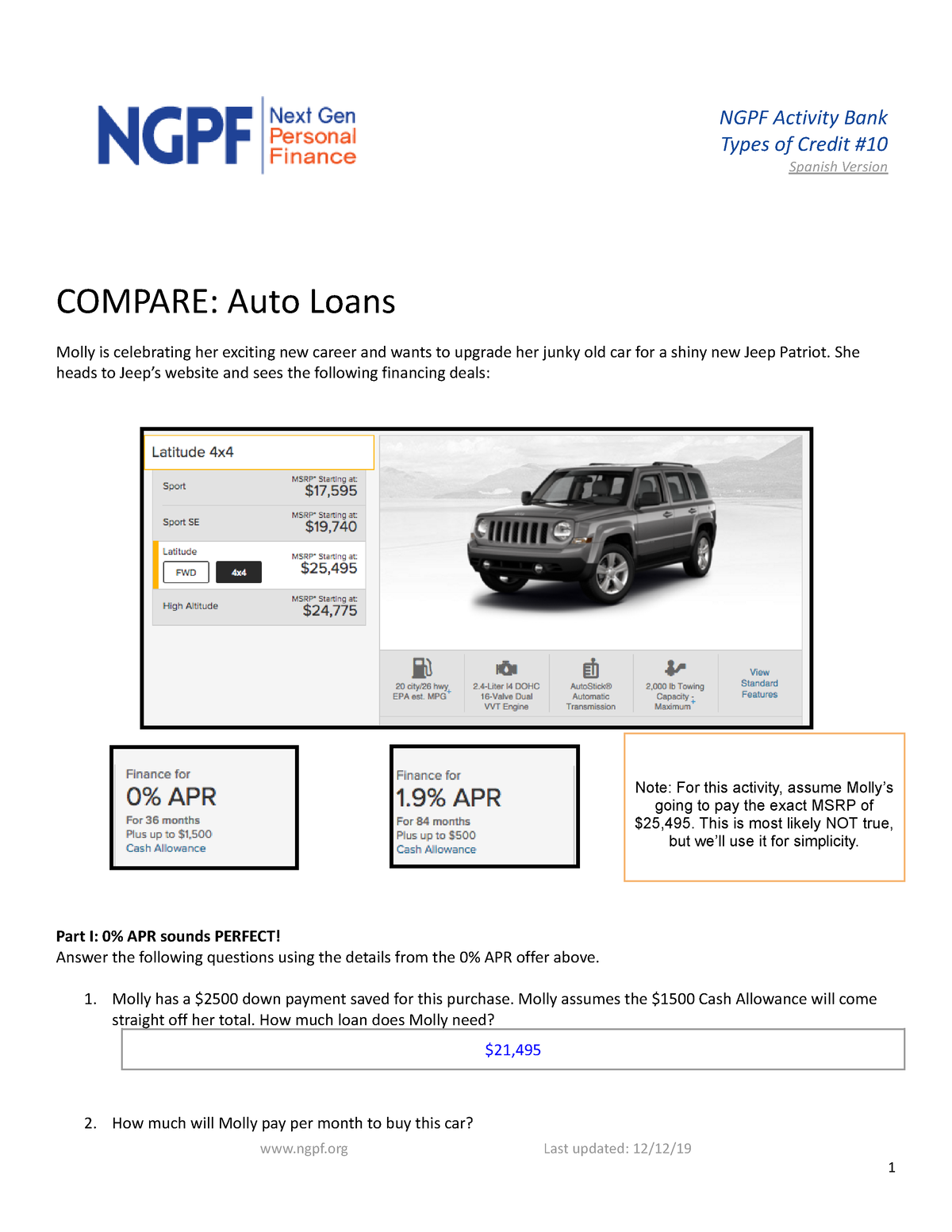

See Before you can Owe is actually a couple of mortgage instructions from the user Monetary Coverage Bureau (CFPB). It suggests home loan https://paydayloanalabama.com/grant/ seekers the new procedures they have to capture to start and handle a home loan account. It provides detailed information into rates, and you will demonstrates to you what are comparable revenue to your funds, too.

This will make sense. Household candidates should know what they’re joining. And who wants gotcha minutes or abrupt clarifications after it seems (or actually is) too late so you can back out?

Very, the loan bank legally need to allow the borrower a formal set off closing disclosures at the very least three working days ahead of closure day.

Improved Revelation Material: A response to the borrowed funds Crisis Fall out.

Discover Before you could Owe support consumers learn both mortgage processes, as well as their choices. The latest CFPB, a federal agencies, works to keep lending practices fair getting regular people. Regarding the agency’s very own terms: We help keep banking institutions and other monetary service providers people count for each big date operating very.

Before latest Learn Before you Owe bundle was made, there were four revelation variations. These people were not very easy to discover, or to fool around with.

One altered following the casing drama you to unfolded anywhere between 2007 and you will 2010. Indeed, the newest government mortgage law itself changed.

This season, the Dodd-Honest Wall surface Road Change and Consumer Defense Act led loan providers in order to generate lending conditions more strict, to help you reduce the threats so you can consumers. By 2015, the brand new CFPB had their basic Learn Before you can Are obligated to pay products. They simplistic the loan revelation material that lenders had to bring the borrowers.

Home loan Disclosures Are really simple to Discover, Simple to use-And you may Customized to possess Mortgage Customers.

Today, the latest CFPB webpages comes with the Home ownership area. So it an element of the webpages guides the fresh optimistic loan debtor owing to the borrowed funds-trying to thrill. It’s tips, suggestions, and notification.

- The mortgage Imagine. This shows the brand new contract the buyer is actually to make – specifics of the loan and all the relevant costs. It says the interest rate, and you can if that is closed from inside the. Whether your terms penalize borrowers which shell out its monthly amount early, it document claims therefore. All of the told, the loan Estimate can help financing candidate know precisely what is available, upcoming shop around and you will evaluate available mortgages over the past times before closure time! See just what financing Imagine works out.

- The Closure Disclosure. It will help your prevent expensive unexpected situations within closure dining table. Do the loan Estimate satisfy the Closure Revelation? This new toolkit shows the person how exactly to contrast which file – their number and you will financing conditions – with the exact same facts where they look towards the Mortgage Imagine. The latest debtor gets around three business days examine these variations and you will ask questions prior to going finished with the newest closure. See just what a closing Revelation ends up.

The house Loan Toolkit gets borrowers the mandatory framework to learn such disclosures. As well as the mortgage lender provides one for every single debtor. See just what the house Financing Toolkit (PDF) looks like.

Understand Your Rights, and you can Understand Laws, the newest CFPB Says

Contemplate, all of the mortgage borrower are permitted a closing Disclosure at the very least about three business days before the brand new action transfer. This might seem like a pain in the neck to have an upbeat client lead on finishing line. But, as you are able to today come across, discover a consumer-friendly rationale for this three-day several months. It allows buyers to change the heads throughout the closure in the event that something’s significantly less promised. It includes a-flat time when property visitors gets clarifications on techniques together with language, explain any questions otherwise dilemma, or maybe even demand change with the home loan arrangement.

At that time, the agency’s online publication can be hugely useful, even for an experienced visitors. It offers worksheets, budget variations, plus try role-to relax and play scripts the customer can use to arrange the real deal conversations into the mortgage company.

it says to customers what mortgage ripoff is, and just why to not take action. Saying well-known? Sure, however individuals carry out fudge amounts, therefore possibly they actually do need to be told it’ll likely perhaps not end better!

Home loan Companies Need to Agree Individuals inside a completely independent Ways. Very Need Their App!

In , brand new CFPB awarded advice to loan providers on the having fun with algorithms, also phony intelligence (AI). Cutting-boundary technology produces a myriad of individual study accessible to loan providers. These firms should be in a position to articulate hence research versions its conclusion. They can’t just say the new AI did it. So the pointers alerts loan providers not to just draw packets towards the models in place of saying this explanations, in the each situation, when they turn some one down for mortgage loans. Once they dont follow this guidance, he or she is unpleasant the brand new federal Equivalent Borrowing Opportunity Work. In reality, this new Equal Borrowing from the bank Chance Act means lenders so you’re able to specify the precise things about refusing to material financing.

What makes that it? Because when the loan providers let us know straight-up as to why our company is deemed ineligible, up coming we could understand how to go-ahead afterwards, and you may increase our borrowing character properly. And, they reassures us you to definitely unlawful prejudice is not from inside the play. It is ergo that CFPB says the financial institution have to county the detail by detail findings you to went into denial. In other words: The items did the fresh applicant manage or perhaps not do?

Plus, the CFPB states within the discharge titled CFPB Facts Tips about Credit Denials from the Lenders Having fun with Artificial Cleverness, a lender must straightforwardly share why, it does not matter that applicant would be shocked, upset, or angered to find out they’re being rated toward investigation that may perhaps not intuitively interact with the finances.