Brand new natural audacity dudes has will never quit to surprise myself

Kelsey Queen got to help you Fb with a stack out of screenshots indicating the fresh new so-called texts sent through Facebook. It was before entire voice messaging state banged of, although brand new texts was indeed undoubtedly ready, these were absolutely nothing compared to the hidden spoken ramblings which were to follow.

“I am talking about uh ... K. Crap. Mayhaps which was a taaaad caught up having a stranger risk message for the a bright Saturday morning.

An excellent Canadian lady has actually mutual the new seriously creepy sound messages she states she gotten thru Fb regarding a person she don't matches with with the Bumble

Kelsey replied by the asking the fresh guy if she know your, that is exactly what people should do in that situation.

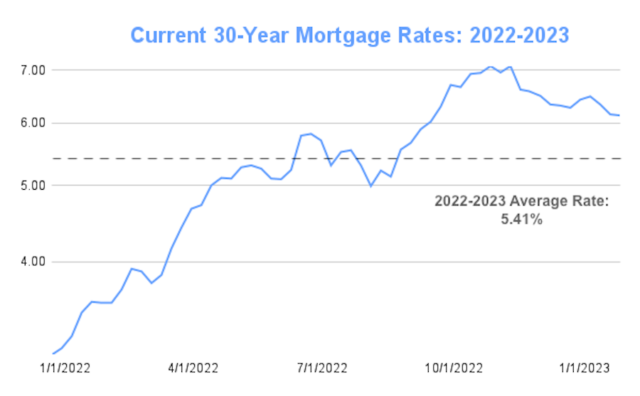

Failing continually to Score Numerous Rates Of Additional Loan providers

To stop some typically common errors buyers generate also can serve to good huge financial. Listed below are mistakes that ask you for several thousand dollars in the a possible financial.

To order a property 's the biggest pick you likely will previously make. It’s to your advantage locate quotes away from several lenders examine and just have the best bargain. Looking at other lenders permits you the ability to examine and you can compare pricing, settlement costs, and you will recommendations to have PMI. Look around having some lender versions, from home loans and you will borrowing unions to help you big an internet-based loan providers. Making the effort discover numerous estimates can result in significant savings.

Prepared Long Ahead of Dealing with Borrowing Points

Your credit score are a respected indication of one's availability and measurements of the mortgage you could potentially qualify for. It needs time for you to obtain the performs you will do to resolve the borrowing dilemmas right now to appear on credit history. If you waiting long before making the required alter, your credit rating might not increase enough after a while to be eligible for increased mortgage. It is important to check the rating on a regular basis with a reliable supply to find an accurate credit rating and be able to remain monitoring of it.

Simple tips to Grab a collateral Demand for Individual Assets?

As a whole, Article 9 of one's Uniform Industrial Password (“UCC”) governs protected purchases connected with private possessions and it has already been then followed when you look at the all condition. Article provides that there exists a few actions involved in the manufacturing out-of an individual assets guarantee interest, “attachment” and you may “perfection.”

“Attachment”

“Attachment” 's the minute where a safety appeal is generated inside the brand new equity. With the protection focus to install on the collateral, (a) really worth must be offered with the safeguards interest, (b) the brand new pledging party has actually liberties on the security, and you may (c) brand new pledging cluster gets into a safety contract. On illustration of a mortgage where the bank is actually requiring a lot more americash loans Troy individual assets security, the loan is actually the value considering. The protection agreement would be as part of the mortgage records together on the promissory note, loan contract, and you may home loan otherwise deed regarding trust.

The latest vital element of accessory is actually making certain brand new pledging team genuine is interested regarding personal assets getting sworn. A familiar error happen in which a lender thinks it is bringing a guarantee demand for new possessions of the team that's performing during the topic assets insurance firms the fresh debtor sign a guarantee coverage contract, nevertheless company is indeed being operated by an occupant or member of your own borrower.

¿Cuándo tomar esteroides?

¿Cuándo tomar esteroides? La decisión de cuándo tomar esteroides es un tema que genera muchas dudas y controversias, especialmente en el ámbito del deporte https://anabolizantes-es24.com/ y la salud. Es fundamental entender cuándo y por qué se pueden utilizar estos compuestos, así como los riesgos asociados. Uso médico de los esteroides Los esteroides anabólicos

Five Popular Version of Contingencies in A home inside the Virginia

Imagine finding the perfect home for your family which have an amount tag within your budget. But due to the sizzling hot real estate market and you may battle to own the home, you made a decision to exclude the recommended contingencies when you look at the real estate transactions. Unfortuitously, exactly what checked too-good to be real rapidly turned into a beneficial nightily first started lifestyle around. The fresh new plumbing system had significant issues demanding expensive repairs; the newest rooftop leaked throughout the most of the violent storm, and you may worst of all of the - the basements flooded with regards to rained heavily.

But not, when the there were contingencies set up, such demanding a property review just before get or a condition demanding the vendor to fix any damage prior to closing, you'll have eliminated these issues.

Standard Financing Closing Data and a brief Reason ones „>>,“slug“:“et_pb_text“>“ data-et-multi-view-load-tablet-hidden=“true“>

The fresh Closing Statements

These data files, referred to as Closing Disclosures (CD) , for the buyer and you will vendor (for each and every provides their unique independent Cd), detail this new bookkeeping mixed up in closure. Here the buyer discover an enthusiastic itemized range of the costs, including its sales speed, loan charges, name charges, governmental costs, attract, homeowner's insurance, escrow account beginning balances, examination costs or other contractual personal debt totaled following an itemized a number of the new credits it discover, along with its serious deposit, home mortgage harmony, supplier closing costs concessions, and you can taxation prorations are typical totaled and these credits try subtracted regarding the disgusting amount due and you may reflect extent the customer will owe. The fresh new Seller's Closure Revelation performs backwards of your Buyer's Closure Revelation. It starts with totaling the new Seller's Credits after which totaling this new Seller's charges, following subtracts the fresh costs about credits and you can shows brand new “net” selling continues for the Seller.

The buyer receives a Cd reflecting only their bookkeeping but has small print into the Financing Program picked and it perhaps not closed by the or recognized by the vendor, from all of these mortgage terms and conditions. The seller individually cues a Computer game highlighting just its accounting.

Both Dvds was then joint to your a closing Report understood while the ALTA closing revelation which contains both bookkeeping regarding the customer and supplier in one single file and is also finalized of the the Consumer, Supplier and you can Settlement Representative.

Needs some thing tangible that i normally ticket right down to my students

Show which:

- Simply click to share with you to the X (Opens inside new screen)

Like most clients, it had been hard to help save to have a down payment. She struggled to place money away once the she juggled the brand new higher cost of living Lazy Lake loans locations, debt, crisis expenses and you will automobile insurance.

Both of my parents was property owners, she said inside the Sep. My personal dad are a homeowner. I do want to getting a citizen.

More than just a week later, on twenty six years of age, Timmons closed with the an effective colonial into the Detroit's west side, because of the city's downpayment direction program.

The applying provides doing $twenty five,000 inside cash to licensed basic-big date homebuyers, and that's one of the work to improve homeownership in the an area in which, for many years, most customers leased.

The bill have managed to move on lately. The newest display off Detroiters whom individual the brand new belongings they inhabit enhanced when you look at the 2023 to help you 54%, up regarding 50% the earlier year, U.S. Census Bureau research inform you. The consequences should be life-modifying, which have rents usually outstripping month-to-month financial debts and you may homeownership due to the fact base to help you strengthening generational money.

Still, Detroit-built construction benefits say people struggle to get property throughout the urban area due to reasonable credit scores, too little savings plus the higher costs and you will reduced accessibility away from high quality homes.

New program's basic round enjoys helped 434 citizens pick house, and you can bullet 2 is actually underway, having Detroit Gran Mike Duggan claiming it serves as an unit to have Vp Kamala Harris' suggestion to incorporate to $twenty five,000 when you look at the deposit assistance.

Therefore, do you know the chief style of lenders, and you may what type is right for you?

Springtime form plants, warmer temperature ... and you can a home-purchasing frenzy. That's because the fresh most hectic days buying otherwise promote a house are generally April, Get and June. And you may regardless if you are an experienced house-hunter or a first-date consumer, it is very important learn your home-financing choices before starting the method.

To try to get this choice, you ought to very first obtain home loan approval of a performing lender

The newest Colorado Houses and you will Financing Expert will bring valuable assist with earliest-day homebuyers in the form of deposit advice gives and second mortgages. This type of programs succeed more comfortable for Tx house which have average and you can lower earnings purchasing a house.

Homebuyers who have fun with CHFA first mortgage loan programs to finance their property get will get be eligible for a lot more assistance with the down fee and settlement costs. You are still allowed to explore among the many following possibilities, even although you donate to your deposit:

And try HUD's list step 1 for other software from inside the Connecticut

- CHFA Downpayment Guidelines Give: Certified borrowers can discover as much as step three% of its first mortgage (amount borrowed capped within $25,000). You obtain help in the type of an offer, so that you need-not pay off that money.

- CHFA Next Home loan: This method has the benefit of an excellent forgivable mortgage all the way to cuatro% ($twenty five,000 maximum) of your own first-mortgage in the place of a complete grant. You merely pay back the borrowed funds harmony when the particular occurrences can be found, such as if the first-mortgage try reduced, after you sell otherwise re-finance your property, otherwise after you prevent utilising the household since your no. 1 residence.

How to get So much more Matches for the Bumble inside the 2024: The greatest Publication

Swipe correct or left for the Bumble to own little? Remain calm. Comprehend right here the real deal suggestions that will be certain that you suits. Or even realize about Bumble, its one of the most put matchmaking programs.

Bumble keeps an interesting ability where a lady directs a message so you're able to start discussion and also make the first move. Even though this works well for a few people, it generates an elevated difficulties to possess guys during the attracting appeal. Yet not, don't enkelt fraskilte kvinner get worried!

Ranging from undertaking a profile that cannot end up being overlooked around choosing a fascinating reputation images we are going to leave you tips that will elevate your possible fits rates. Also, we shall explore messaging campaigns and you will ways doing deep dating just after matching.

Are you a beginner within Bumble relationship app otherwise not able to change your efficiency? Sit and sustain discovering.