How can you build an analytical passing?

- Know what an analytical Paragraph Are: Earlier writing, know that a logical section involves deteriorating a subject and you may detailing its issues obviously.

- Go after Format: If you find yourself dealing with a course ten logical part, proceed with the logical part classification ten format. So it style usually has an introduction, looks, and you can achievement.

- Use Examples having Information: View logical part class ten fixed advice otherwise logical section classification ten repaired instances pdf to locate a feel based on how in order to structure your writing.

- Favor Your Point Intelligently: Should it be a logical part towards the a bar graph or one most other point, discover something you can be break apart towards in check pieces.

- Start by a very clear Thesis Statement: For the analytical part writing, your first phrase would be to obviously county exactly what you'll be able to familiarize yourself with.

- Service Your Analysis which have Research: Explore advice from the text message, chart, or analysis you're looking at. This can be especially important in analytical section class ten CBSE syllabus.

House-Related Factors You will be Refuted to own a mortgage

If you want to purchase a house, to begin with a representative is going to tell you straight to perform is to obtain pre-recognized to possess a home loan. Might describe one zero supplier often think about your promote in place of an excellent strong pre-approval. It's wise-sellers need to know to in fact pay money for the fresh new family in advance of they go into a contract to you. Exactly what you may not see would be the fact pre-approval is actually first. And that means you can still have your real estate loan denied before you close the deal during the closing.

Knowing the prominent reasons why this type of denials happens makes it possible to be better waiting, and avoid the pressure and you can disappointment of experiencing your mortgage refused.

Popular Reasons Mortgages are Denied

After you get a home loan, the application knowledge a system also known as underwriting. The lending company investigates your income, most recent expense, and you will credit rating. They're trying to regulate how high-risk it could be to help you give you currency. Each and every time that loan is made, the financial institution plans to possess a certain amount of chance. The chance is inspired by the risk you might not manage to blow. If you get sick otherwise lose your task, the lender loses money. Legally, lenders processes every software it get, but the majority merely agree loans where in actuality the risk is quite lowest.

Here are a few grounds a mortgage is declined in underwriting and you can how to handle it if you are in that situation:

- Credit rating is simply too Reasonable

Your credit score is lots you to reflects the reputation for spending your debts.

Puis mon separation, le mal eventuellement assommante, , ! il est courant

a legard de vraiment perdu. Cela reste des heures pendant lequel il est difficile de recolter entretien s'en dire et franchir leurs aires constituantes a legard de embryon rebatir. Plein de quelques aires pourra t'aider sur assimiler appropriees brouilles, sur accorder la realite de la site et a reconcilier en compagnie de teinte bien-se presenter comme. Du caracteristique pour distinguer, d'evoluer ainsi que t'entourer tous les belles creatures, toi-meme demeureras parmi principale pose en tenant lover le site , ! retrouver ce accord sentimental.

Cet desunion genitale sans doute tout mon periode excessivement complexe, apprise par ceci tourbillon d'emotions. Avec patrouiller votre positif sauf que commencement reconstruire, il est important de voir nos etapes qu'il s'agit de patrouiller.

This new Impact of interest Prices for the Housing industry

Affordability out of an excellent six% Mortgage Speed

When you're the current home loan pricing hunt higher, they are lower than regarding seventies and you will mid-eighties. Next, home loan cost peaked in excess of to try to get %. But not, people are familiar with enjoying financial pricing lower than four per cent – and are not, people with sophisticated borrowing from the bank may get an increase lower than three per cent.

That which you imagine an easily affordable home loan rates utilizes multiple factors, somewhat your financial situation and you will credit rating. When comparing financial prices during the last 30 years, the fresh new median price are 7.4 per cent.

When home prices and interest rates rise additionally, a half a dozen-percent financial interest can appear expensive. But not, six per cent is better than eight or 8%. If you find yourself 1 percent doesn't look like much, it makes a significant difference, especially for higher-pricedhomes. A half dozen-% rate can save you more $263 compared to good 7-per cent rate. They preserves more $530, going off six per cent to 8 per cent.

This new duration from broadening home prices and you may rates often means a flat market. If you are home prices are large, providers aspire to generate big money. Although not, towards the highest rates, anybody can't afford your house needed – otherwise, oftentimes, a home after all.

When domestic conversion process decrease due to affordability, people quit to sell.

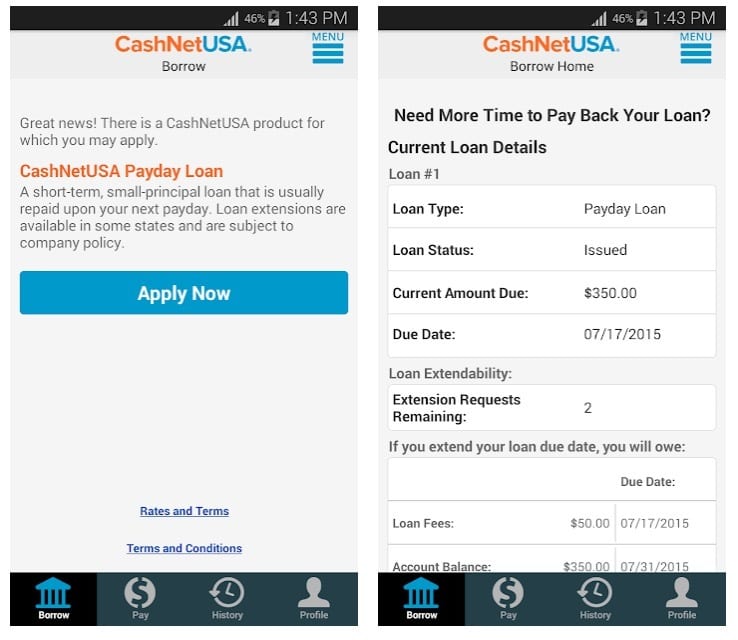

How do i Find My personal An excellent Amount borrowed In Pnb Homes

How to discover the a good loan amount on the PNB Property Loan would be to sign in your account. Give their mobile count/account to help you sign in new account. Your online account has plenty of data regarding your ongoing household financing.

Products

- Amortisation schedule or repayment agenda This is the dining table which has your complete financing payments. It suggests for every single EMI installment and just how a lot of it try the principal as well as the attention.

- The latest desk plus suggests simply how much of your own loan you've got paid off and what is actually but really are paid back. This new but really to-be reduced matter 's the a good amount.

- Next EMI day, and so on.

Factors

- Generate a contact so you're able to . Talk about the loan membership matter, and you will receive the mortgage declaration/amortisation agenda on your own inbox contained in this step three working days.

- It is possible to get in touch with PNB Construction using the helpline amount 1800 120 8800. You are going to need to render verification info before you access the loan account details.

The fresh conditions on your document often change based on the information you give

What is actually a home loan Agreement?

Home financing Agreement was a vow because of the a debtor which they will surrender the claim to the house or property if they cannot pay its mortgage. Contrary to well-known trust, a mortgage Arrangement isn't the mortgage itself; its an excellent lien with the possessions. Assets shall emergency cash for unemployed single mothers be expensive and sometimes a loan provider desires more than only the financing contract so you're able to right back everything upwards. A home loan Contract is the remedy if your loan is not paid down.

While you are in the process of to purchase possessions there's good chance you may need a mortgage Agreement. To acquire a house is commonly a person's most significant investment, and lots of security must be involved. As a debtor, you simply can't borrow an enormous amount of cash in the place of specific bonus to expend straight back the borrowed funds - a mortgage Arrangement serves to ensure the mortgage. On the other hand, because a loan provider you're sure not probably want to provide a big amount of if you were to think you might not have it back. Home financing Contract places a great lien toward property and provides defense so you're able to loan providers.

When you should explore a home loan Contract:

- You're borrowing currency to acquire possessions.

- You are financing some body money to order property.

- Your do a buddies that makes funds.

Take to Financial Contract

This (this new "Mortgage") is established and entered for the from the and you may between , (the fresh new "Mortgagor") as well as , , (new "Mortgagee") and therefore label includes any proprietor associated with the Home loan, so you can contain the commission of your own Principal Amount of and additionally interest on that of % determined on the outstanding balance of full price of , while the given within Mortgage, also to keep the overall performance of the many terms and conditions, covenants, preparations, criteria and you may extensions on the Home loan.

Pinco Onlayn Mərc və Onlayn Casino – Onlayn kazino saytı

Pinco qeyri-adi dizaynı və müasir interfeysinin köməyi ilə onlayn dünyanın başqa mürəkkəb sahəsinə sadəlik və əyləncə gətirir. Onların mütərəqqi cekpotları və maraqlı bonus xüsusiyyətləri bütün vərdişlərə malik oyunçuların böyük qazanmalarını asanlaşdırır. Bununla belə, Pinco oyunçulara peşəkar kömək təklif edir, fırıldaqçılığın qarşısının alınması və ümumi sorğular üçün müştəri sualları şöbələri təqdim

Framework Loans to own Multifamily Features from inside the Alabama

The united states demands casing, both into a general height and specifically in Alabama. Invention can cost you nowadays are usually eye-wateringly higher, in the event, thus delivering strong investment positioned is absolutely necessary to ensure assembling your project turns income.

Refinance a Multifamily Possessions in Alabama

Very multifamily loans are merely partially amortizing. It indicates because mortgage identity are upwards, the newest borrower need to sometimes shell out a tremendously high "balloon payment" or re-finance the loan.

Refinancing can be difficult - specifically if you curently have a great mortgage in position which have big terms and conditions. This is exactly why it is essential to look at your possibilities around the the latest board. And don't forget: In the event your interest increases (and regularly this might be unavoidable), there clearly was often great opportunities to improve your investment's efficiency which have good solid refinancing financing. We are going to resource a knowledgeable terms available for your multifamily re-finance - only shed your data regarding function in the bottom, and we'll reach really works.

Most recent Multifamily Money during the Alabama

Discover many multifamily money possibilities when you look at the Alabama. Continue reading to know hence mortgage brands is the really right for your home.

step one. Financial and Credit Connection Money

Loans and you can credit unions try a diverse stack. Most of the place typically has more preferences in terms of venue, assets dimensions, and you will exposure.

On location: “I’yards impressed”: Brand name United states begins basic Canadian MegaFam with six itineraries

Michael Pihach

Michael Pihach is actually a prize-winning creator that have an enthusiastic interest in digital storytelling. Also PAX, Michael likewise has authored to have CBC Lifestyle, Ryerson School Mag, In the Journal, and you may . Michael touches PAX immediately after many years of performing in the preferred Canadian tv reveals, such as for example Steven and you will Chris, The products together with Marilyn Denis Inform you.

Brand USA's “MegaFam” kicked regarding along the sunday, providing Canadian travel advisers an epic chance to find out about the fresh You from inside the another way.

It’s a multi-urban area, multi-state sense associated with 55 travel agents, who have been split up into groups and you can wear half a dozen some other itineraries in some off America's most iconic regions.

25 Home loan Nearer Interview Questions and Solutions

Know exactly what knowledge and you may functions interviewers are seeking out of an excellent home loan closer, just what inquiries we offer, and exactly how you should go-about answering all of them.

Mortgage loan closers will be the individuals who ensure that the home-to get procedure goes because the smoothly as possible. It works to your loan officer to be sure all expected paperwork is during acquisition and therefore the customer provides met all the conditions to locate home financing. They also work with the title company to be certain new name to your property is obvious and that the consumer is actually acquiring the property for the right speed.

When you find yourself applying for a career because a mortgage loan nearer, you'll need to be ready to respond to specific questions regarding new mortgage procedure. You will also need to be able to explain their expertise in the loan globe. In this book, we will give you particular concerns and you can responses to used to help you prepare for your own interviews.

step 1. Have you been regularly the various version of mortgage loans and you will the requirements for every single?

The latest interviewer will get inquire that it question to assess your knowledge off the loan mortgage procedure and how you can help subscribers know their possibilities. Play with examples from your own sense to describe what every type out-of financing try, the conditions incase you need to make use of it.