Why must We believe a private mortgage lender?

What you should Know

- Private mortgage lenders promote short-title mortgage loans as an alternative to the top banking companies.

- Individual mortgage loans has actually higher rates of interest and you can charges, but they’ve been easier and you will less as accepted to own.

- Consumers that may change into the personal lenders are people with crappy credit, those who trust international or abnormal money provide, and you may newcomers to help you Canada rather than a position background.

- Preferably, personal mortgages are used given that a short-term services when you improve your bank account.

What exactly are individual mortgage lenders?

Personal lenders is actually individual businesses and people one provide aside their currency. For example Financial Financing Companies, where funds from individual buyers are pooled to pay for syndicated mortgages. Personal lenders do not undertake deposits throughout the societal, in addition they commonly federally or provincially managed.

Personal mortgage loans are usually smaller and you can include highest interest rates and you may costs than those offered by conventional lenders. He could be meant to be a short-term level ahead of transitioning right back so you’re able to normal lenders.

Individual Mortgage lenders Across Canada

Private mortgage brokers has actually continued to become an increasingly popular options having people and possess was able an important role for the Canada’s property sector. Considering analysis throughout the CMHC, non-financial lenders got its start $ billion value of mortgage loans for the 2021.

If you’re next to 50 % of that have been from borrowing from the bank unions, there had been still 306,000 mortgages originated from 2021 from the personal lenders, really worth near to $100 mil. That it incorporated mortgage financial institutions (MFCs), financial money organizations (MIEs), and faith organizations. There are various loan providers where you are able to get a personal mortgage out of.

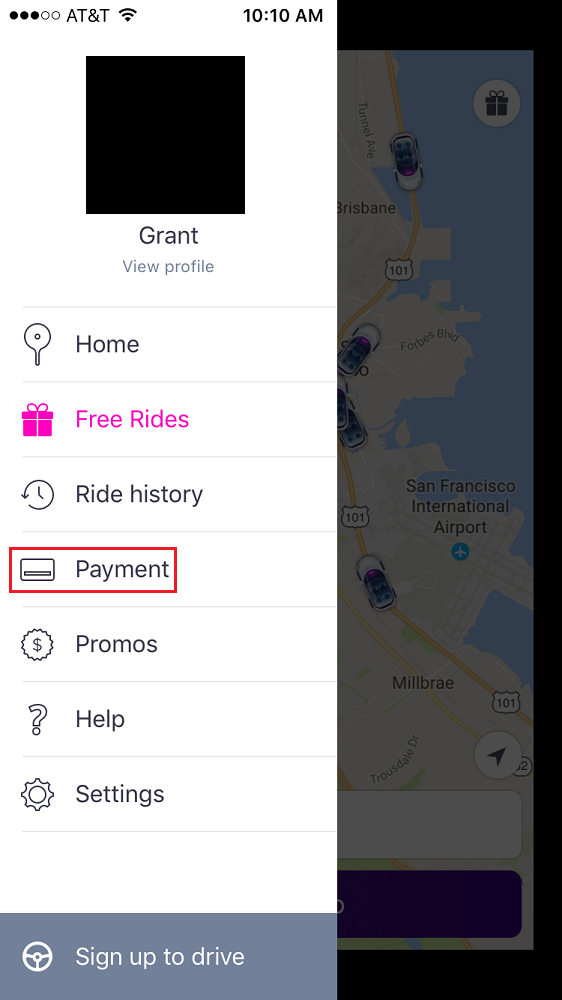

Brand new table lower than lists a selection of individual mortgage brokers in the Canada and compares the personal mortgage cost, limitation LTV ratio, if they create interest-only money, assuming he’s got zero minimal credit rating requisite.

When you yourself have a low or subprime credit rating below 600 , you will likely you would like a private lender. Lenders can use your credit score to adopt their financial fitness, that may result in qualifying to possess a mortgage or perhaps not. Perhaps not forgotten people repayments, which have a decreased borrowing usage rate, holding the lowest (otherwise no) balance toward credit cards, and having a lengthy credit score tend to replace your credit history.

The absolute minimum credit score out-of 600 is needed for CMHC financial insurance. Because so many B Loan providers handle covered mortgages, being unable to be eligible for a CMHC insured financial have a tendency to ban you against of a lot B Lenders. Lenders may also need online payday loan Illinois you to get mortgage insurance policies even though you will be making an advance payment bigger than 20%.

How to have a look at my personal credit history?

Both credit bureaus during the Canada try Equifax and you will TransUnion. You might request your credit rating and credit report from all of these enterprises because of the mail otherwise on the web for free. However they offer more products and services to own a charge, such as for example credit keeping track of.

Equifax and you can TransUnion only declaration pointers within Canada, while they work with of numerous places including the Us. Your credit report external Canada may possibly not be accepted based debt organization. Newbies and you can the newest immigrants so you can Canada possess problems being qualified to own a mortgage whether they have a finite Canadian credit history.

Who can individual mortgage lenders let?

Private mortgage lenders help complete new pit left of the antique lenders. Individuals with a restricted Canadian credit history, particularly brand new immigrants, could possibly get deal with more difficulties of trying discover financial acceptance away from banks. Home loans may also help people who have troubles delivering acknowledged to own a home loan. Other benefits is available towards the all of our web page throughout the mortgage brokers compared to financial institutions. At the same time, private lenders might help another individuals.