What are the most readily useful options to help you do-it-yourself money?

Often, mortgage enterprises may have an assessment clause built into the loan contract that can need you to notify the bank of any home improvements you’re planning into the completing. This could be renovations particularly completing a cellar, strengthening a platform, constructing a connection, otherwise dressed in another peak. not, certain minor things like repainting the fresh structure or installing the fresh new carpeting might not have to be analyzed by your mortgage lender. Most frequently, lenders will likely approve new home improvements, especially if they may be able put worth to your home, yet not, become safer, you should always notify their financial of any forecast renovations otherwise renovations methods before cracking ground.

How do you apply for a property update mortgage?

There are numerous solutions to help you a home improve mortgage you you will definitely envision, although not, a couple of better choices are using bucks or opening a good credit line.

If you have a property improvement project planned, the way to shell out the dough has been dollars. You might get a developer or a designer to make some arrangements that one may after that present to a company for a great bid. When you located a quote, you can start placing currency aside for each spend period going to investing in your property improvement endeavor. Be mindful just like the specific offers are just appropriate to have a specific time period, not, you might properly guess that even although you must keeps an extra bid complete after you’ve secured the money, the fresh bid are someplace in the newest ballpark of your very first bid.

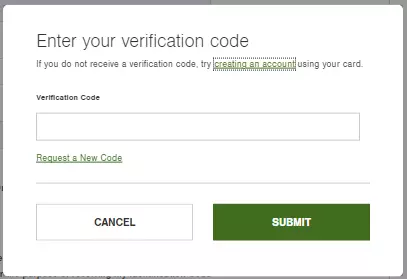

A line of credit is quite useful for do it yourself methods regardless if you are employing experts otherwise working on the project on your own. After approved to have a certain purchasing restrict, you can access that cash as a result of an alternative debit card, from the creating a, otherwise by taking cash out regarding a part otherwise Automatic teller machine. You could potentially get as little or as frequently of the funds as you want, and you can repay it each month enabling you to take back space in your credit limit because you go. Such financial support is perfect for spending because you go do-it-yourself strategies where you could shell out contractors, plumbing technicians, electricians, and purchase content as you need over the course of the fresh new endeavor.

How will you choose the best do it yourself loan?

Choosing the best do it yourself loan isnt an emotional techniques, but not, you can even make certain you cover your entire bases to ensure that you get the best package you’ll be able to into a home upgrade financing considering their borrowing and you will financial predicament. You really need to contrast interest rates, readily available mortgage terms, monthly obligations, in the event that you will find any extra charge such as late costs or early pay-away from punishment, if in case the mortgage is sold with one unique software or perks. Getting applications and you can advantages, searching to have such things as rates offers when you indication upwards to own autopay, unemployment safeguards, and you can mortgage deferment possibilities. Plus, you can even spend some time discovering customers critiques to help you see if you can find any consistent grievances on a certain financial or if there are one warning flag one to emerge important source.

The best way to opinion a few of these different facets in advance of acknowledging that loan promote and you will deciding to manage a particular lender is to prequalify. Once you prequalify, you could potentially remark the latest rates, words, fees, and you may unique applications regarding numerous loan providers top-by-front as well as the same time frame. This helps tremendously when you are trying pick the fresh new trick differences when considering lenders additionally the money which they provide.