Aug step one What you should do Whether your Spouse* Keeps Good credit but No Income

If the partner have good credit however, no income, you could ask yourself if you’re able to are their own in your mortgage software.

How much does They Mean In the event your Wife Possess Good credit However, No Money?

Credit ratings and money you should never wade hand-in-give. A person can has great borrowing from the bank however, zero earnings, otherwise vice versa. Some people have good credit and a beneficial income. That’s the best of both worlds.

Whether your partner enjoys a good credit score it is a stay-at-family mom otherwise doesn’t work for other cause, she nonetheless is able to make it easier to qualify for high resource terms and conditions even although you possess a lowered credit rating. This will depend on which their credit history suggests.

How does Credit Work at a wedded Couples?

Maried people do not have the same credit ratings. As you may have some joint membership which affect the borrowing results furthermore, the credit bureaus fool around with the personal lines of credit and expenses you got through your lifestyle so you’re able to calculate your credit rating.

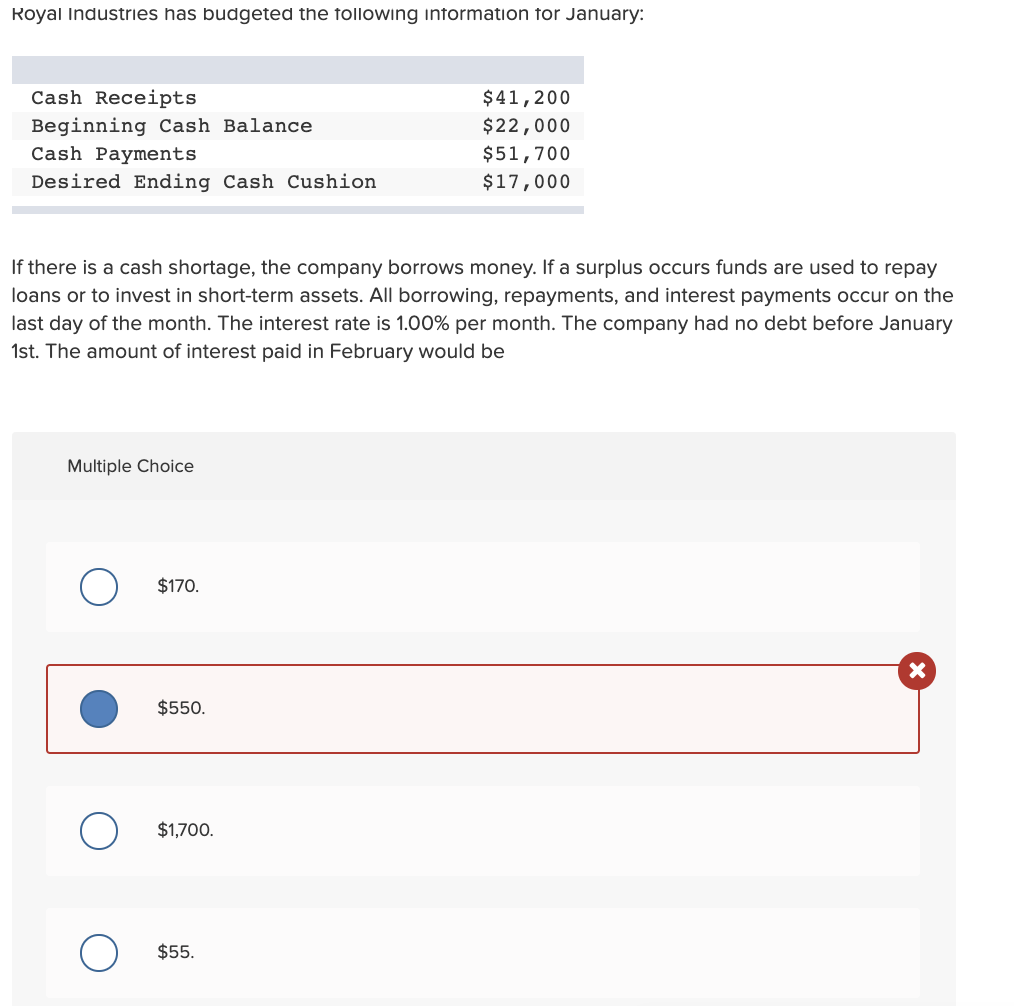

Customers provides around three credit scores, and you can lenders determine financing qualification utilising the all the way down center rating (i.age. any kind of spouse’s middle score, out from the about three fico scores, is gloomier) between partners. For those who have poor credit, your wife’s high credit history is a compensating reason behind letting you safer resource, however it might not be sufficient to get you the best terms and conditions readily available.

In the event your Partner Has Good credit however, No Earnings

Whether your partner possess good credit however, no money, you might question when it is a or damaging to your financial state. Thankfully that it’s better than if the she got less than perfect credit. A wife having bad credit with no earnings wouldn’t let your safer the newest financing or rating glamorous terms, and you would have to get-off their away from people programs to possess domestic or automobile financing. In the event the she has very good borrowing, it can be used to help replace your likelihood of recognition.

But some circumstances apply at the loan recognition rate, together with your credit ratings and you can personal debt-to-income proportion, it is not only an issue, thank goodness.

Good credit opens a great deal more selection to have funds. Particularly, you have quick and future options or a chance to compare rates from additional loan providers. Good credit scores supply a great deal more real estate loan opportunities. That is beneficial when you have bad credit but a beneficial good earnings. Your wife’s highest credit scores could help.

Mortgage lenders normally make the lower center rating when there will be shared individuals; although not, other loan types, such as for instance playing cards, may only thought one credit history away from for every mate.

A beneficial credit profile goes a considerable ways on a loan application. You will have a great deal more solutions for https://paydayloansconnecticut.com/west-haven/ several loan providers and you will financing selection. To put it differently, you’ll not become trapped with just loans designed for those with less than perfect credit.

In the event a person’s credit try crappy, with a mutual applicant with great borrowing is counterbalance the lowest score and help you have made accepted.

Good credit score makes it possible to reach finally your monetary needs less. Like, you may be qualified to receive reduced home loan terms and conditions when you have higher score. If you can score an excellent 15-seasons in the place of a 30-season home loan, you could potentially shell out the home loan regarding in two the amount of time, leaving more funds for other monetary needs.

You may want to use a good credit score score so you’re able to be eligible for glamorous mortgage consolidation choices to decrease your monthly premiums and you will spend their expense out-of smaller.

High credit helps you progress terms to your financing otherwise give more selection for funding, it may suffer unfair to you if one lover isn’t really contributing to the loan payment and other personal debt repayments. A credit score cannot make ends meet, whatsoever.