You only pay the financing commitment to make use of the bucks your use of it

Individual later years account (IRA): An alternate government system that allows you, in some instances, so you can decrease the commission of money taxation towards the some money you rescue, hence decreases the number of tax due. IRA guidelines determine how much money you can save significantly less than this system, how you can ensure you get your coupons aside, and exactly how far income tax you eventually pay.

Inflation: An increase in all round rate quantity of products or services; rising prices ‘s the opposite of deflation. An individual Price List and also the Music producer Rates Directory will be the most typical tips away from inflation.

Insurance: Defense against specific losses subsequently in exchange for occasional repayments (select insurance premium). You can get insurance rates that will spend you (or individuals your identity) specific amounts in case of demise, injury, collision, and other ruin.

Premium: An intermittent fee getting safety up against losses. How big is this new payment is based on certain chance factors. Like, your auto insurance advanced depends partially in your decades.

Interest: A cost paid for the usage of another person’s currency. The financing connection pays your desire, known as dividends to use the cash it will save you indeed there.

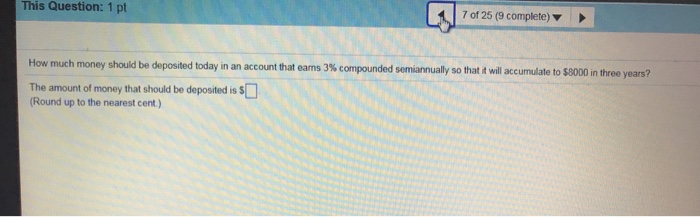

Rate of interest: A share you to definitely says to just what borrowed money will cost or coupons often secure. An interest rate equals interest won otherwise billed annually separated by dominant amount, and you will conveyed because a percentage. Throughout the simplest analogy, a good 5% rate of installment loans in San Jose AZ with bad credit interest ensures that you will be charged your $5 in order to obtain $100 having per year otherwise it is possible to earn $5 to have staying $100 inside a bank account getting a year. (The newest mathematics is more complicated if lender uses a good each and every day otherwise month-to-month interest rate. A new side effects occurs when individuals build financing repayments and you will savers add or withdraw coupons occasionally in the 12 months. Get a hold of including compounding.) Rates toward a mortgage try known as mortgage cost otherwise mortgage cost.

Lien: An appropriate say that offers a loan provider otherwise carrier the straight to a secured asset whenever a borrower defaults

Internal revenue service (IRS): The fresh new institution of the national which is responsible for event government income and other taxation and you can enforcing the principles of the institution of your treasury.

Investor: An individual who purchases a secured asset to your income it’s going to secure and you may the elevated worthy of it will have afterwards.

Business masters: One thing useful you to definitely a manager gets employees as well as money. Employment advantages differ extensively from organization to help you organization and you can usually try offered to complete-date specialists and frequently so you can region-time specialists into the good prorated basis. Gurus ranges regarding medical health insurance on the individual room from inside the the firm parking lot.

But to the bank, financing was an asset because it signifies money the financial institution gets subsequently the debt try paid back

Higher Cap: A pals which have a market capitalization off $ten billion or higher. That it title is normally used when making reference to high-limit brings.

Liability: One thing due to another team. (Get a hold of and obligations and you will loanpare which have advantage.) An equivalent goods useful might be one another a secured item and a responsibility, dependent on your own point of view. Including, with the debtor financing is actually an accountability because stands for bad debts that has to be reduced.

Like, if a loan provider possess put a great lien on your own family and you will that you don’t pay the loan, the lending company can take possession of your property.

Credit line: An arrangement between a lending institution and you will a consumer that sets a maximum mortgage balance the bank often allow the debtor to maintain. The new borrower can draw upon the fresh new line of credit on when, as long as he or she does not meet or exceed the maximum devote new arrangement.