Suspense accounts and error correction

When the process is finished, the accountant may finally terminate the suspense account and transfer the money to the correct account. It improves the quality of book-keeping and proper representation of all the transactions. It is like a temporary shelf where all the “miscellaneous” items can be parked until their actual nature can be ascertained. When we record uncertain transactions in permanent accounts, it might create balancing issues. These accounts are designed to temporarily hold mortgage payments that are either incomplete or cannot be immediately applied to specific portions of the loan, such as principal, interest, taxes, or insurance. Suspense accounts serve as temporary holding areas for transactions that cannot be immediately classified.

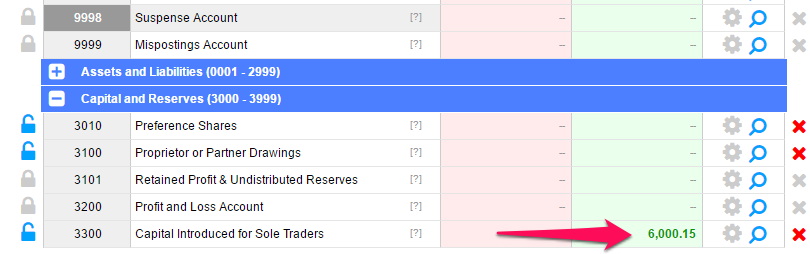

Examples: Suspense Account Journal Entries

They are the placeholders that keep the accuracy of your financial records intact while you figure out the account where the transaction belongs and add it to the general ledger. A suspense account is a general ledger account prepared in the following situations;1. Differences arises between the total debit side & the credit side of the trial balance. In situations involving complex financial transactions or unique circumstances, it can be challenging to determine the appropriate accounts to record the entries promptly.

Impact on Financial Statements

- In such cases, a suspense account can be used to temporarily hold the transaction until it can be rectified and reclassified correctly.

- QuickBooks suspense account is a control account that works as a holding account until any issue is highlighted or the unrecognizable transaction is detected.

- Then it distributes the mortgage payment to the creditor, the homeowners insurance to the insurance company, the property tax to the government, and a fee to itself.

- While businesses of all sizes normally include a suspense account within their accounting scheme, they are of particular concern to insurance companies.

- You can hold them in a suspense account until you know which account they should move to.

- Other details may also be unclear, such as the amount of the transaction or the payee.

A trial balance is the closing balance of an account that we calculate at the end of the accounting period. When the two sides of the trial balance don’t match, we hold the difference in a suspense account until we correct it. If the debits in the trial balance are larger than credits, we record the difference as a credit. Then, we close the account after making the necessary adjustments so that it’s no longer part of the trial balance.

Potential for errors

Because transactions in a suspense account are unallocated, the account should be considered temporary. For example, payments may be received with invalid or unclear account information. Other details may also be unclear, such as the amount of the transaction or the payee. Once the accountant has enough information, they can reassign the transaction out of the suspense account and into the appropriate account within the general ledger.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Do Mortgage Suspense Accounts Earn Interest?

If you get a payment, but you don’t know who has sent it, you may need to place the amount in a suspense account. Once you have checked invoices and other correspondence and confirmed with the client or customer, you can then move the amount to the appropriate account. At times, all the required details for a particular transaction are not available but it still needs to be recorded in order to keep the accounting books updated. In short, a suspense account is the point of last resort when you need a short-term holding bay for financial items that will end up somewhere else once their final resting place is decided.

If payments don’t cover all dues or lack allocation details, they are placed in suspense until resolved. This ensures payments are applied correctly, preventing potential servicing errors. A suspense account in accounting is like a temporary storage room where you keep transactions that do not have a clear place to go in the financial records. When a transaction occurs and it’s not immediately clear where it should be recorded, it goes into this mystery box until more information is available to properly classify it.

For an accountant to show a suspense account on balance sheet documents is more direct than it seems, because it isn’t much different from other accounts. For instance, if the accountant or the owner isn’t sure suspense account in balance sheet which account to place a transaction into, then it’ll be moved to the suspense account for the time being. Sometimes, accounting teams don’t have all the necessary information for a particular transaction.

The payment relates to IT support services which Michelle will make use of from 1 September 20X8 to 31 August 20X9. Suspense accounts on balance sheets are not desirable since they might make it difficult to balance the books appropriately. In case a suspense a/c is not closed at the end of an accounting period, the balance in suspense account is shown on the asset side of a balance sheet if it is a “Debit balance”.