What is Chart of Accounts COA: Definition, Examples & Structure

Businesses experienced rapid growth and an increase in transactions. At this point, they demanded a more structured and standardized approach to accounting to help them track their finances, manage inventories, control costs, and assess their financial performance. If the business offers manufacturing services to others, a separate revenue account, Manufacturing services, is included to track income from these services. Plus, keeping an eye on different expense types helps the company control its costs and ensure money is spent where it matters most. And when it comes to audits (those thorough checks of financial records), having a clear COA makes everything a lot easier, keeping everyone happy and following the rules.

How can a chart of accounts be used in financial reporting?

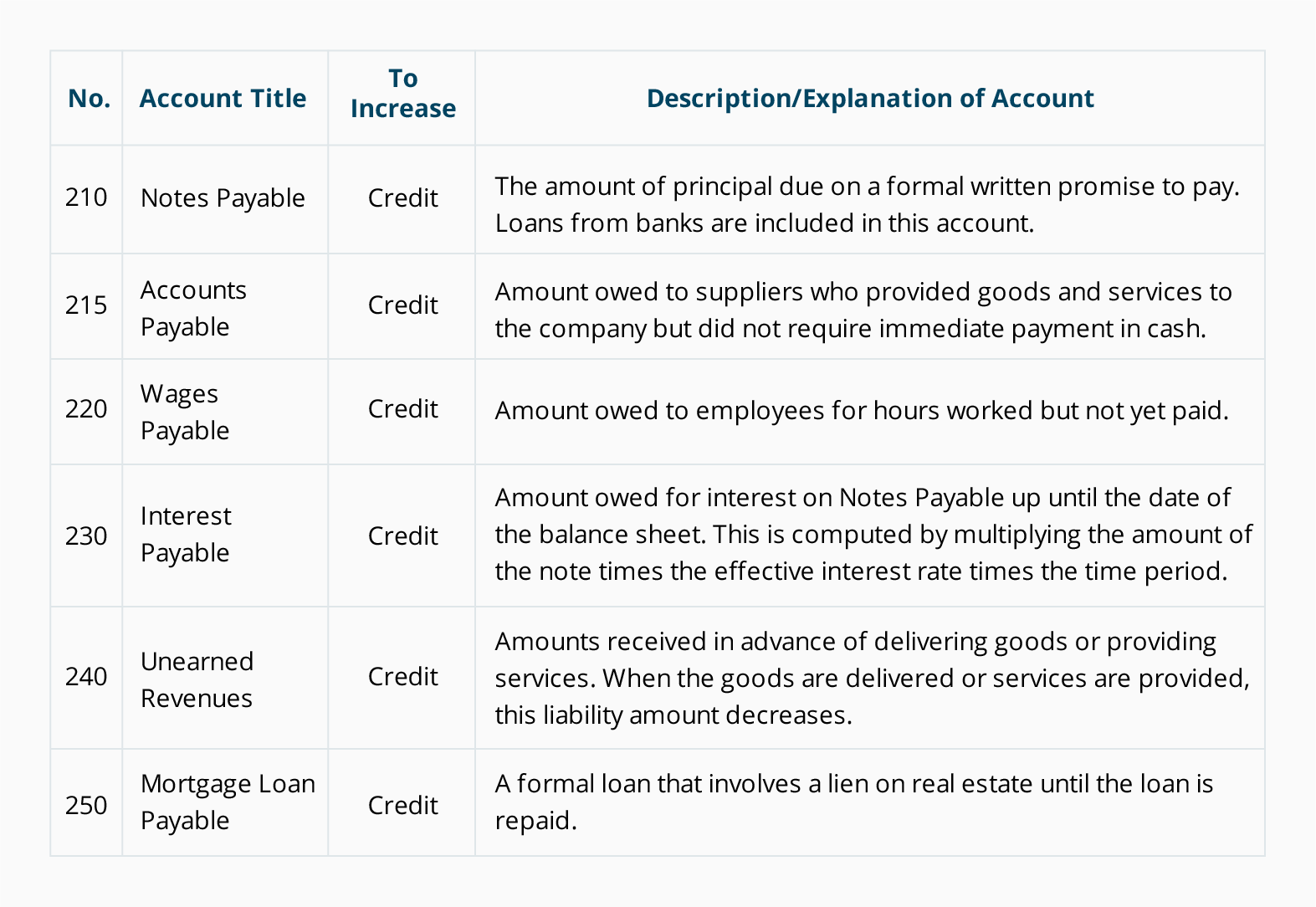

“Unearned revenues” are another kind of liability account—usually cash payments that your company has received before services are delivered. Learn how to build, read, and use financial statements for your business so you can make more informed decisions. Kristen xero wrapslight green pearl Slavin is a CPA with 16 years of experience, specializing in accounting, bookkeeping, and tax services for small businesses. A member of the CPA Association of BC, she also holds a Master’s Degree in Business Administration from Simon Fraser University.

Is There a Single COA Format?

Back when we did everything on paper, or if you’re using a system like Excel for your bookkeeping and accounting, you used to have to pick and organize these numbers yourself. But because most accounting software these days will generate these for you automatically, you don’t have to worry about selecting reference numbers. Revenue accounts keep track of any income your business brings in from the sale of goods, services or rent. The chart of accounts is a very useful tool for the access it provides to detailed financial information for individuals within companies and others, including investors and shareholders. But the final structure and look will depend on the type of business and its size.

Thirteen Steps to Set Up Your COA

It aids in identifying spending trends, profitable areas, and potential savings that are crucial for strategic planning and budgeting. By adhering to these best practices, you can maximize the utility of your chart of accounts, enhancing both financial transparency and decision-making capabilities within your organization. This helps in organizing the accounts systematically and simplifies the process of adding new accounts in the future. Each account within the COA is typically assigned a specific number, which helps in identifying and organizing financial information efficiently.

Align with accounting standards

Also, it’s important to periodically look through the chart and consolidate duplicate accounts. The chart of accounts can vary from one business to another, but they generally fall into five major categories based on the business’s needs and operational complexity. Understanding these types can help businesses choose or design a COA that best fits their accounting requirements. To help illustrate the types of accounts that can be included in a chart of accounts, here are some common examples categorized by type. While these examples are not exhaustive and may vary depending on the specific needs and nature of the business, they can provide a useful starting point for building a chart of accounts. The chart of accounts is useful in maintaining consistency and data integrity in recording transactions.

To create a COA for your own business, you will want to begin with the assets, labeling them with their own unique number, starting with a 1 and putting all entries in list form. The balance sheet accounts (asset, liability, and equity) come first, followed by the income statement accounts (revenue and expense accounts). Asset, liability and equity accounts are generally listed first in a COA. These are used to generate the balance sheet, which conveys the business’s financial health at that point in time and whether or not it owes money. Revenue and expense accounts are listed next and make up the income statement, which provides insight into a business’s profitability over time. A chart of accounts is a comprehensive list of all the accounts used by a business to record its financial transactions.

Here’s a step-by-step guide to help you establish a COA that suits your business needs and enhances your financial reporting capabilities. Take note that the chart of accounts of one company may not be suitable for another company. It all depends upon the company’s needs, nature of operations, size, etc. In any case, the chart of accounts is a useful tool for bookkeepers in recording business transactions. Before recording transactions into the journal, we should first know what accounts to use.

- Since different types of entities use different types of accounts, there is no one single chart of accounts template that would be applicable to all businesses.

- Other Comprehensive Income includes gains and losses that have not yet been realized but are included in shareholders’ equity.

- This would include your accounts payable, any taxes you owe the government, or loans you have to repay.

Marketing expenses is another expense account to track promotional costs. The COA also includes accounts for online payment systems to monitor digital transactions. Keeping an updated COA on hand will provide a good overview of your business’s financial health in a sharable format you can send to potential investors and shareholders. It also helps your accounting team keep track of financial statements, monitor business financial performance, and see where the money comes from and goes, making it an important piece for financial reporting. Large and small companies use a COA to organize their finances and give interested parties, such as investors and shareholders, a clear view and understanding of their financial health. Separating expenditures, revenue, assets, and liabilities helps to achieve this and ensures that financial statements are in compliance with reporting standards.

An expense account balance, for example, shows how much money has been spent to operate your business, whereas a liabilities account balance shows how much money your business still owes. Your chart of accounts is a living document for your business, meaning, over time, accounts will inevitably need to be added or removed. The general rule for adding or removing accounts is to add accounts as they come in, but wait until the end of the year or quarter to remove any old accounts. Incorporating the Maker Checker Workflow adds an additional layer of accuracy and control by implementing a dual-approval process for all entries and adjustments made to the COA.