Closing Entries Accounting Examples Beginners:Step by Step

This is an optional stepin the accounting cycle that you will learn about in futurecourses. Steps 1 through 4 were covered in Analyzing and Recording Transactions and Steps 5 through 7were covered in The Adjustment Process. The $9,000 of expenses generated through the accounting period will be shifted from the income summary to the expense account. In this example, the business will have made $10,000 in revenue over the accounting period. In this example, it is assumed that there is just one expense account. LiveCube Task Automation is designed to automate repetitive tasks, improve efficiency, and facilitate real-time collaboration across teams.

Step 4: Close withdrawals to the capital account

Failing to make a closing entry, or avoiding the closing process altogether, can cause a misreporting of the current period’s retained earnings. It can also create errors and financial mistakes in both the current and upcoming financial reports, of the next accounting period. After the posting of this closing entry, the income summary now has a credit balance of $14,750 ($70,400 credit posted minus the $55,650 debit posted). However, some corporations use a temporary clearing account for dividends declared (let’s use „Dividends“). They’d record declarations by debiting Dividends Payable and crediting Dividends.

How much will you need each month during retirement?

Finally, you are ready to close the income summary account and transfer the funds to the retained earnings account. You need to create closing journal entries by debiting and crediting the right accounts. Use the independent chart below to determine which accounts are decreased by debits and which are decreased by credits. Remember that revenue accounts normally have a credit balance so here we are debiting them to zero them out.

Stay up to date on the latest accounting tips and training

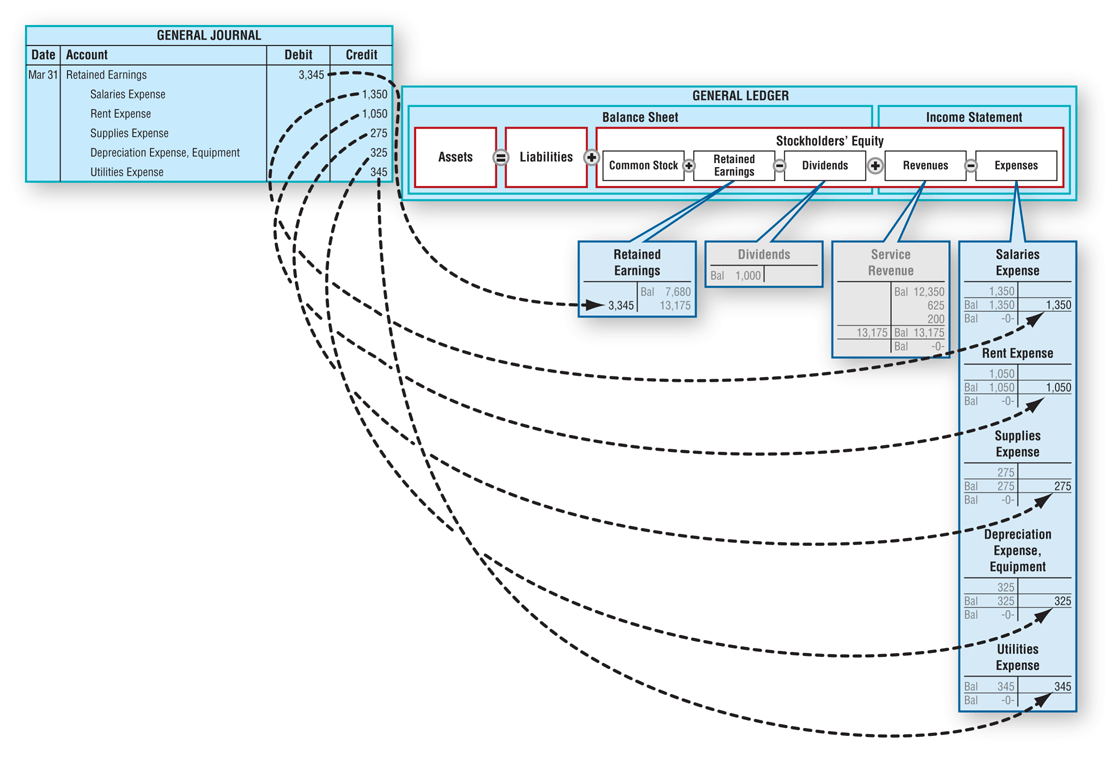

Closing entries are the journal entries used at the end of an accounting period. Do you want to learn more about debit, credit entries, and how to record your journal entries properly? Then, head over to our guide on journalizing transactions, with definitions and examples for business. Thus, the income summary temporarily holds only revenue and expense balances. After most of the cycle is completed and financial statements are generated, there’s one last step in the process known as closing your books. Remember that all revenue, sales, income, and gain accounts are closed in this entry.

What is the approximate value of your cash savings and other investments?

- This is the same figure found on the statement ofretained earnings.

- Basically, the income summary account is the amount of your revenues minus expenses.

- Expense accounts have a debit balance, so you’ll have to credit their respective balances and debit income summary in order to close them.

- It’s not reported on any financial statements because it’s only used during the closing process and the account balance is zero at the end of the closing process.

To make them zero we want to decrease the balance or do the opposite. We will debit the revenue accounts and credit the Income Summary account. The credit to income summary should equal the total revenue from the income statement. To close revenue accounts, you first transfer their balances to the income summary account. Start by debiting each revenue account for its total balance, effectively reducing the balance to zero. Then, credit the income summary account with the total revenue amount from all revenue accounts.

Step #3: Close Income Summary

Most companies close on a monthly or annual basis but that isn’t to say it is uncommon to see a quarterly or semi-annual close. They are special entries posted at the end of an accounting period. Prepare the closing entries for Frasker Corp. using the adjustedtrial balance provided. Printing Plus has a $4,665 credit balance in its Income Summaryaccount before closing, so it will debit Income Summary and creditRetained Earnings.

The income statementsummarizes your income, as does income summary. If both summarizeyour income in the same period, then they must be equal. However, if the company also wanted to keep year-to-dateinformation from month to month, a separate set of records could bekept as the company progresses through the remaining months in theyear. For our purposes, assume that we are closing the books at theend of each month unless otherwise noted. Closing entries are an important facet of keeping your business’s books and records in order.

Temporary accounts are used to record accounting activity during a specific period. All revenue and expense accounts must end with a zero balance because they’re reported in defined periods. A hundred dollars in revenue this year doesn’t count as $100 in revenue for next year even if the company retained the funds for use in the next 12 months. The purpose of closing entries is to merge your accounts so you can determine your retained earnings.

By leveraging advanced workflow management, the no-code platform, LiveCube ensures that all closing tasks are completed on time and accurately, reducing the manual effort and the risk of errors. Organizations can achieve a 40% increase in close productivity, resulting in a more streamlined financial close process and allowing your team to focus on more strategic activities. Now, all the temporary accounts have their respective figures allocated, showcasing the revenue the bakery has generated, the expenses it has incurred, and the dividends declared throughout the past year. Let’s investigate an example of how closing journal entries impact a trial balance. Imagine you own a bakery business, and you’re starting a new financial year on March 1st. An accounting period is any duration of time that’s covered by financial statements.